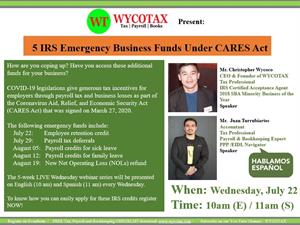

5 IRS Emergency Business Funds Under CARES Act

Two COVID-19 legislations give generous tax incentives for employers through payroll tax and business losses. The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) was signed on March 27, 2020, it was a supplement to Families First Coronavirus Response Act (FFCRA), signed March 18, 2020. The following emergency funds include:

1. Employee retention credit

The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50 percent of the qualified wages an eligible employer pays to employees after March 12, 2020, and before January 1, 2021.

2. Payroll tax deferrals

Section 2302 of the CARES Act provides that employers may defer the deposit and payment of the employer's portion of Social Security taxes and certain railroad retirement taxes.

3. Payroll credit for sick leave

Two weeks (up to 80 hours) of paid sick leave at the employee's regular rate of pay where the employee is unable to work because the employee is quarantined.

4. Payroll credit for family leave

The FFCRA provides businesses with tax credits to cover certain costs of providing employees with required paid sick leave and expanded family and medical leave for reasons related to COVID-19, from April 1, 2020, through December 31, 2020.

5. New Net Operating Loss (NOLs) under CARES Act

Under CARES Act, Net Operationg Loss (NOL)from year 2018, 2019, and 2020 can be carried back up to 5-years. This permits for an immediate claim for refund for businessess who had taxable income during the carryback time period.

Resource: https://www.irs.gov/

The 5-week Wednesday webinar series will be presented on English (10 am) and Spanish (11 am) every Wednesday.

To know how to easily get these IRS credits register Now!

Register Now!

Bonus! Subscribe on our You Tube channel for other Tax Videos: WYCOTAX

FREE Tax , Payroll & Bookkeeping CHECKLISTS: https://wycotax.com/

Disclaimer: This material has been prepared for informational purposes only and is not intended to provide and should not be relied on for tax, legal and accounting advice. WYCOTAX, LLC is a profit company and not associated with any aforementioned institution.

Date and Time

Wednesday Aug 5, 2020

10:00 AM - 10:30 AM CDT

Location

Online: https://zoom.us/j/3060558988

Fees/Admission

FREE